Qualified Charitable Distribution

-

Qualified Charitable Distributions from IRAs

A qualified charitable distribution (QCD), also known as an IRA charitable rollover gift, allows individuals 70 ½ or older to make an outright gift of up to $100,000 from an IRA directly to the College and exclude it from taxable income.

REQUIREMENTS OF A QCD

- The IRA account holder must be age 70 1/2 or older at the time the distribution is made to the College.

- Distributions are limited to $100,000 per individual per year and must be transferred directly from the IRA custodian to the College.

- Distributions can only be directed from a traditional or Roth IRA (not from a retirement plan such as a 401(k), 403(b), etc.).

- Distributions cannot be made to a donor advised fund or supporting organization (including most private foundations) or used to fund a charitable gift annuity or charitable remainder trust.

No goods, services, or income can be received by the donor in exchange for the gift. Donors should consult their financial adviser; as other requirements may apply.

BENEFITS OF A QCD

- Satisfies all or part of annual required minimum distributions (RMD) and provides a charitable giving strategy for donors who do not need the additional income.

- May be used to fulfill any outstanding pledges.

- Maximizes giving by allowing donors to give outside of the 60 percent of adjusted gross income (AGI) charitable deduction limit.

- Provides value for non-itemizers and donors who live in states that do not allow charitable deductions.

- Minimizes tax liability and can put donors at a lower threshold for Medicare premiums by reducing income.

Donors should work closely with their IRA custodian to request a direct distribution to the College.

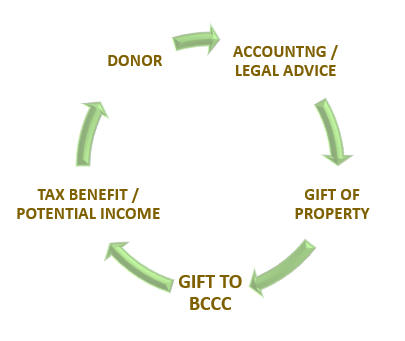

GIFTS OF REAL ESTATE

A gift of real estate to Baltimore City Community College is a unique way to provide a lasting benefit to education and research. It is also a convenient way for you to enjoy a charitable deduction based on the current fair market value of your property and to reduce the size and complexity of your estate.

BENEFITS OF GIVING REAL ESTATE

Federal law has special incentives in place to encourage certain forms of private philanthropy, especially gifts of real estate. Giving real estate can result in significant benefits including:

- Reduced income and estate taxes

- Avoidance of capital gains taxes

- Lifetime income for you or loved ones

- Continued use of the contributed property during your life

Because a gift of real estate will usually be sold as soon as practicable after it is gifted, the real estate must be free of debt and must be readily marketable. An added benefit is that in most cases, all aspects of its sale are handled by the College.

OPTIONS FOR GIVING REAL ESTATE

Not only can real estate be used to make outright gifts, it can also be used to make future gifts to the College. For example, should you wish to give a remainder interest in a piece of real estate now but still desire to live in or continue to vacation in the property for the rest of your life, you may do so. This is known as a retained life estate.

On the other hand, if you have a need for current income, you may wish to use a piece of real estate that you no longer wish to use to fund a trust which will provide valuable financial support to you and your family for years to come.

Disclaimer:

The information on this page relating to Gift Planning is intended to provide general information that we hope will be helpful to you in your tax, estate, and charitable planning. It is not intended as legal advice and should not be relied upon as legal advice. Figures, calculations, and tax information are based on federal tax laws, regulations, rulings, and rates applicable at the time such information was prepared. Individual state laws may have an impact on the availability of gift annuities. For advice or assistance with your particular situation, you should consult an attorney or other professional adviser.