Charitable Lead Trusts

-

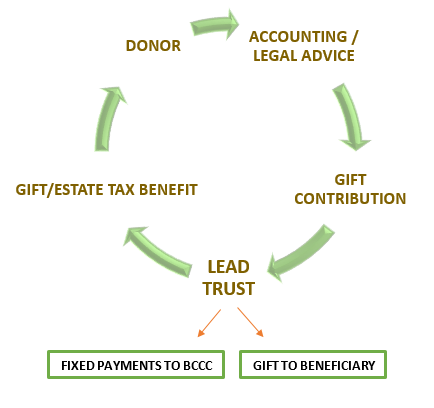

A charitable lead trust works by first using the assets contributed to the trust to make annual payments to the College for a term of years (usually 10 to 20). At the end of the term, the assets remaining in the trust pass to the non-charitable beneficiaries, without passing through the donor’s estate.

BENEFITS OF A CHARITABLE LEAD TRUST

A charitable lead trust allows a donor to make a significant gift to the College, minimize his or her taxable estate, and pass assets on to non-charitable beneficiaries, such as children.

Charitable lead trusts are fairly complex vehicles with many variables to consider. It is recommended that an attorney be consulted in connection with any charitable lead trust proposal. However, with proper thought and preparation, a charitable lead trust can be an excellent way for a donor to reach personal charitable and tax-planning goals.

Disclaimer:

Disclaimer:The information on this page relating to Gift Planning is intended to provide general information that we hope will be helpful to you in your tax, estate, and charitable planning. It is not intended as legal advice and should not be relied upon as legal advice. Figures, calculations, and tax information are based on federal tax laws, regulations, rulings, and rates applicable at the time such information was prepared. Individual state laws may have an impact on the availability of gift annuities. For advice or assistance with your particular situation, you should consult an attorney or other professional adviser.